Which Banks Offer Executor Accounts in the UK (2026)

What Is an Executor Account and Why Is It Necessary?

Executor accounts serve a clear and practical purpose: they provide a secure, separate place to hold estate funds during the administration process. These accounts ensure that incoming funds such as proceeds from the sale of property or investments can be received, while also enabling the payment of funeral expenses, debts, taxes and, eventually, distributions to beneficiaries.

From a legal standpoint, they are a tool for transparency and proper record-keeping. For solicitors and executors alike, an executor account simplifies estate administration by avoiding co-mingling of personal and estate monies. In practice, many firms handling probate rely on these accounts to demonstrate compliance and uphold their fiduciary obligations.

Which Banks Offer Executor Accounts in the UK?

Although not all banks explicitly promote executor accounts, several of the UK’s major high-street institutions provide them on request. Requirements may vary, but in most cases, a Grant of Probate (or Letters of Administration) is needed before an account can be opened.

HSBC UK

HSBC offers a dedicated executor account that allows for the clear segregation of estate funds. Executors must present the Grant of Probate and relevant ID before the account can be opened.

Barclays

Barclays provides an Executor and Trustee account, typically opened at branch level. All appointed executors must usually be present during account setup, which can pose logistical challenges for non-local parties.

Lloyds Bank and Bank of Scotland

Lloyds allows for the creation of an Executor account either by opening a new one or converting an existing estate-related account. ID and probate documentation are required, and services may vary by branch.

NatWest and Royal Bank of Scotland (RBS)

NatWest and RBS offer Executor accounts once legal authority is proven. These accounts allow for incoming estate funds and outgoings such as taxes or debts, but generally must be managed in person or via post.

Yorkshire Bank / Clydesdale Bank

Though less prominently advertised, Yorkshire Bank and its affiliates are known to provide executor accounts on request. Availability may differ by region, and contacting the branch directly is often necessary.

Common Challenges with Bank-Provided Executor Accounts

While traditional banks offer executor accounts, legal practitioners often encounter delays and administrative hurdles. Some common limitations include:

- Branch-only applications, requiring in-person visits by all executors

- Long processing times, particularly during peak probate periods

- Limited digital access, with little scope for remote management

- Unclear terms or inconsistent availability across regions

These friction points can be particularly problematic for firms dealing with high-value or time-sensitive estates, as well as for lay executors unfamiliar with probate processes.

Why Third-Party Managed Executor Accounts Offer a Streamlined Alternative

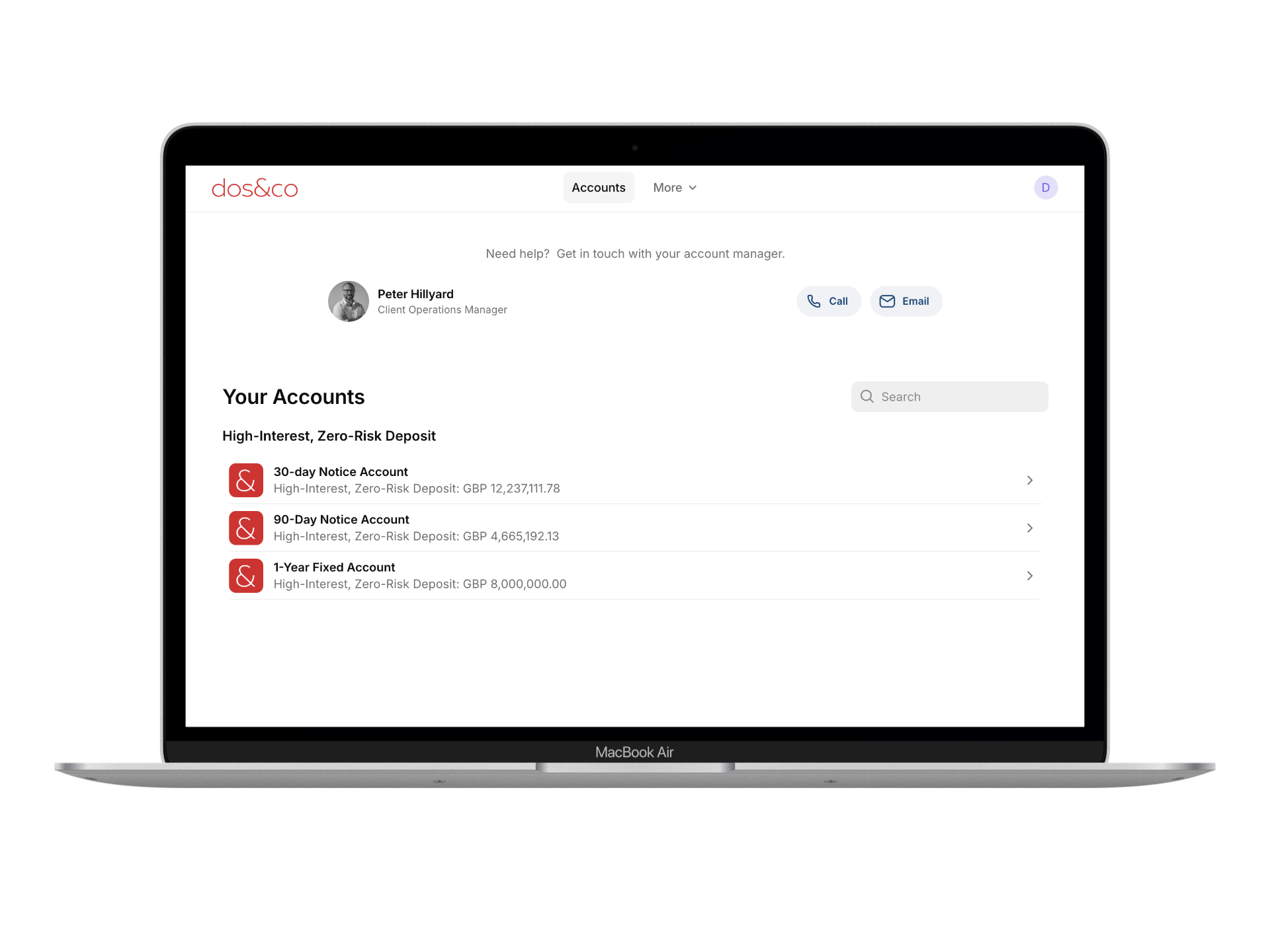

For legal professionals seeking efficiency, security, and control, third-party managed executor accounts provide a modern alternative. One such provider is dospay, whose Probate & Executor Accounts are specifically designed for solicitors, estate administrators, and family representatives.

How dospay Works

dospay's accounts are safeguarded and held at the Bank of England, removing counterparty risk and offering peace of mind for high-value estates. The setup process is digital, with rapid onboarding and a secure online portal that allows for real-time monitoring and record-keeping.

Key advantages include:

- No need for in-person bank visits or excessive paperwork

- Enhanced transparency for multiple stakeholders

- Full compliance with SRA and estate administration standards

- Dedicated support tailored to legal practitioners

For professionals handling complex or multi-party estates, the simplicity and security of dospay’s solution can materially reduce administrative overhead.

How to Choose the Right Executor Account

Selecting the appropriate executor account depends on several factors:

- Estate complexity: High-value or multi-asset estates benefit from digital-first, secure accounts.

- Probate timelines: If timing is critical, streamlined onboarding can prevent unnecessary delays.

- Number of executors: Coordinating multiple signatories is easier with remote access.

- Regulatory requirements: Solicitors must ensure client funds are held compliantly and transparently.

While high-street banks remain a viable option for straightforward cases, the added convenience and risk mitigation offered by third-party services may better suit firms managing diverse client portfolios.

Conclusion

Executor accounts are an essential instrument in effective estate administration. While several UK banks continue to offer them, they often come with operational inefficiencies that frustrate both solicitors and lay executors. Third-party managed solutions such as dospay’s Probate & Executor Accounts deliver a purpose-built, regulation-compliant alternative that streamlines the process while offering unmatched financial security. For legal professionals, embracing these modern tools could translate into faster, cleaner, and more accountable estate settlements.

.jpeg)